The Gas Turbine MRO Market In The Power Sector is Estimated To Witness High Growth Owing To Shifting Focus Towards Preventive Maintenance

The Gas Turbine MRO Market in the Power Sector is estimated to be valued at US$ 13.07 Bn in 2023 and is expected to exhibit a CAGR of 6.7% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

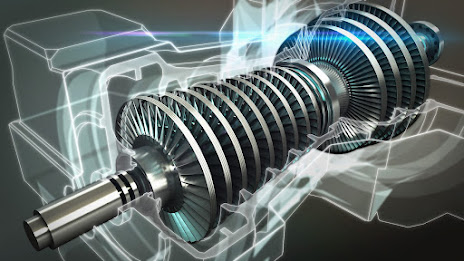

The gas turbine MRO market in the power sector deals with maintenance, repair,

and overhaul services for gas turbines used in power generation. Gas turbines

are critical equipment used in power plants and require routine maintenance and

component replacement to function efficiently and reduce failure risks. Their

MRO helps extend asset life by ensuring reliable operation as per performance

standards.

Market key trends:

One of the major trends driving the gas turbine MRO market is the shifting

focus towards preventive maintenance. Gas turbines are capital-intensive

equipment and any failure can result in high repair costs and loss of

generation. Therefore, most utilities have started following strict preventive

maintenance schedules that involve periodic inspection, testing, cleaning, and

replacement of components as per OEM guidelines. This helps detect issues at an

early stage and prevent unplanned breakdowns. For instance, General Electric

conducts condition monitoring of turbine assets to optimize maintenance cycles.

Such preventive strategies help improve asset availability and life. This

rising preventive maintenance adoption supports the growing demand for gas

turbine MRO services.

Porter's Analysis:

Threat of new entrants: The gas turbine MRO market in the power sector requires

significant resources and capital to enter. Established players have economies

of scale and access to technical expertise that poses barriers for new

companies.

Bargaining power of buyers: Power sector utilities that procure MRO services

have significant bargaining power given the indispensable nature of gas

turbines. However, major OEMs and independent service providers balance this

out by providing customized solutions and services.

Bargaining power of suppliers: Major component OEMs like GE and Siemens wield

influence as suppliers of critical spare parts and expertise. However,

availability of alternative part suppliers and in-house repair capabilities of

utilities ensures pricing is competitive.

Threat of new substitutes: Gas turbines dominate thermal power generation.

Renewables are substitute technologies but their adoption depends on location-specific

factors and policy support limiting threat in short-term.

Competitive rivalry: Intense as major OEMs and independent service providers

compete on technology, services portfolio, geographic reach and lifecycle cost

reductions to utilities.

SWOT Analysis:

Strengths: Proprietary technologies, expertise in critical repairs and

upgrades, global service networks.

Weaknesses: Higher costs for new entrants, dependency on aging fleet for

revenues in future, vulnerability to policies favoring renewable energy.

Opportunities: Growth in power demand, fleet expansions in Asia Pacific and

Middle East, opportunities in performance upgrades and digital solutions.

Threats: Low carbon policies promoting renewables, economic slowdowns impacting

new plant additions, increasing localized MRO capabilities.

Key Takeaways:

The Global

Gas Turbine MRO Market Size in the power sector is expected to witness

high growth, exhibiting CAGR of 6.7%

over the forecast period, due to increasing investments in operational efficiency

and asset performance optimization programs by utilities.

Regional analysis: Asia Pacific dominates currently owing to large installed

base and growing investments in thermal power capacity additions particularly

in China and India. Europe and North America are also significant regions

however future growth prospects are higher in the emerging markets of Middle

East, Southeast Asia and Africa.

Key players: Key players operating in the gas turbine Mro market in the power

sector includes General Electric Company, Mitsubishi Heavy Industries Ltd, RWG

(Repair & Overhauls) Limited, Metalock Engineering Group, Goltens Worldwide

Management Corporation, Siemens Energy AG, Sulzer Ltd, Doosan Heavy Industries

and Construction, Solar Turbines Incorporated, and Ethos Energy LLC. GE

dominates with wide geographic reach and technology leadership. Independent

service providers are growing in capabilities to address specific customer

needs and reduce OEM dependency over lifecycle.

Comments

Post a Comment